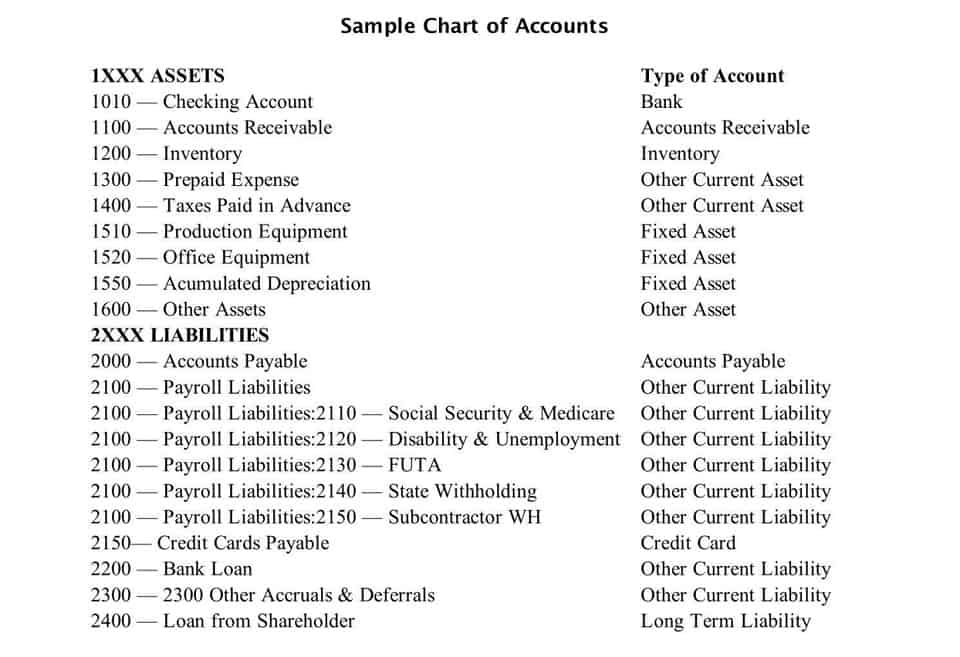

11 3 Accounts and notes payable

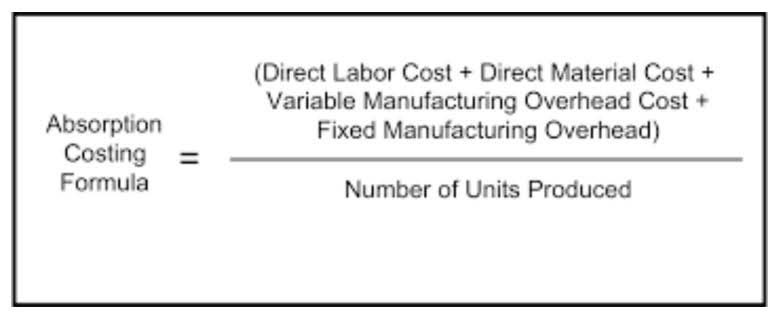

Discount notes are fixed-income securities that do not make interest payments for the duration of the note. Since investors don’t get the added advantage of periodic interest income, the notes are offered at a discount to par. Discount amortization transfers the discount to interest expense over the life of the loan. This means that the $1,000 discount should be recorded as interest expense by debiting Interest Expense and crediting Discount on Note Payable. In this way, the $10,000 paid at maturity (credit to Cash) will be entirely offset with a $10,000 reduction in the Note Payable account (debit). In the preceding entries, notice that interest for three months was accrued at December 31, representing accumulated interest that must be paid at maturity on March 31, 20X9.

Often, if the dollar value of the notes payable is minimal, financial models will consolidate the two payables, or group the line item into the other current liabilities line item. Suppose XYZ Company issues a 1-year, $20,000 promissory note to a lender, but because the interest rate stated on the note is lower than the market rate, the lender only provides XYZ with $19,000 in cash. Notes payable is a liability that results from purchases of goods and services or loans. Usually, any written instrument that includes interest is a form of long-term debt. Finally, at the end of the 3 month term the notes payable have to be paid together with the accrued interest, and the following journal completes the transaction.

The purpose of the discount on notes payable lies in facilitating a transparent and efficient means of incorporating interest costs into short-term borrowing transactions. When companies issue discount notes payable, they receive cash upfront that is less than the face value of the note, with the difference representing the discount. Discounts on notes payable effectively increase the interest rate paid by the borrower, as the cost of borrowing exceeds the stated interest rate on the note. This concept is commonly applied in various financial transactions, including bond issuances and long-term debt instruments, and both lenders and borrowers need to understand its impact on financial statements. In conclusion, the concept of “Discount on Notes Payable” is a crucial element in financial accounting that reflects the time value of money in borrowing transactions. It occurs when a company borrows money by issuing a promissory note at a price lower than its face value, resulting in the company receiving less cash upfront.

A business may borrow money from a bank, vendor, or individual to finance operations on a temporary or long-term basis or to purchase assets. Note Payable is used to keep track of amounts that are owed as short-term or long- term business loans. If you’re looking for accounting software that can help you better track your business expenses and better track notes payable, be sure to check out The Ascent’s accounting software reviews. You recently applied for and obtained a loan from Northwest Bank in the amount of $50,000.

- The dollar amount of the discount is entered on the issuer’s books over the life of the note.

- We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

- To simplify the math, we will assume every month has 30 days and each year has 360 days.

- Retailers and industries with seasonal demand benefit from the flexibility of discount notes.

This interest expense is allocated over time, which allows for an increased gain from notes that are issued to creditors. It must charge the discount of two months to expense by making the following adjusting entry on December 31, 2018. In addition, these debt instruments are considered safe investments due to the fact that they are backed by the full faith and credit of the U.S. government. The purchase of discount notes may also prove to be advantageous for investors who would need access to the funds after a short period of time.

Time Value of Money

The principal of $10,475 due at the end of year 4—within one year—is current. The principal of $10,999 due at the end of year 5 is classified as long term. To simplify the math, we will assume every month has 30 days and each year has 360 days. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Step 3: Maturity

Over time, the discount would be gradually amortized to Interest Expense, thereby reducing the balance of Discount on Notes Payable and increasing the carrying value of the note. In the second case, the firm receives the same $5,000, but the note is written for $5,200. The interest portion is 12% of the note’s carrying value at the beginning of each year. It would be inappropriate to record this transaction by debiting the Equipment account and crediting Notes Payable for $18,735 (i.e., the total amount of the cash out-flows). A problem does arise, however, when an obligation has no stated interest or the interest rate is substantially below the current rate for similar notes.

Issued to Extend Payment Terms

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. https://accounting-services.net/ Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Accounts payable on the other hand is less formal and is a result of the credit that has been extended to your business from suppliers and vendors.

The difference between the two, however, is that the former carries more of a “contractual” feature, which we’ll expand upon in the subsequent section. In contrast, accounts payable (A/P) do not have any accompanying interest, nor is there typically a strict date by which payment must be made. The preceding illustration should not be used as a model for constructing a legal document; it is merely an abbreviated form to focus on the accounting issues.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Interest expense will need to be entered and paid each quarter for the life of the note, discount on notes payable which is two years. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Confirm the maturity value (MV) by adding the face value (FV) to the discount amount (D).

3: Notes Payable

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This is because such an entry would overstate the acquisition cost of the equipment and subsequent depreciation charges and understate subsequent interest expense.

Only interest payments are typically due on notes payable until maturity, as is the case with the bonds used as examples here. In essence, a discount on notes payable helps companies account for the interest cost when they issue notes at less than face value. Properly handling this accounting ensures that financial statements accurately depict the company’s financial position and the true expense of borrowing. Long-term notes payable are often paid back in periodic payments of equal amounts, called installments. Each installment includes repayment of part of the principal and an amount due for interest. The principal is repaid annually over the life of the loan rather than all on the maturity date.